A deep dive into Deep Creek's liquidation

Could Epic buy Deep Creek? Will the brand live on after the brewery operation is sold. Plus: Townshend update. Is the haze clearing for beer? A journey from big beer to no booze.

Welcome to Friday beer friends,

It’s become a sadly regular event to unpick what went wrong when a major brewery fails, as is the case this week with Deep Creek.

There’s so much to unpick here — and more will be revealed when the liquidators’ initial report is released next week.

I feel that the past four months have been overly-dedicated to analysing “what went wrong” and I thought I’d written all there was to write — but the Deep Creek situation adds a new twist to the tangled ball of beer economics in 2023.

When Epic went into liquidation in July, Deep Creek was one of the potential buyers. And the irony is that now that Epic is partly in the hands of the Russell Group, one of New Zealand’s most successful construction companies, there’s a chance Epic could, in fact, buy Deep Creek. Or at least buy the brewery operation.

I’ve had more than one person suggest that to me, and I mentioned it as a possibility to Deep Creek co-founder Paul Brown, who replied: “That would be hilarious”. Except he said it with the deepest sense of irony possible.

Deep Creek wanted to buy Epic to help fill the empty volume in their brewery (and that’s one of the factors we’ll look at below). If they could have brewed Epic and sold it with a fraction of the overheads (sales staff, contract brewing costs) it could have delivered the cash flow they needed.

And cash flow is definitely what they needed. Here’s why:

While the quality issue with bursting seams on cans destined for China delivered the $400,000 hit that tipped Deep Creek over the line into cannot-pay-the-bills territory, the truth is they had been treading water for some time in the post-Covid environment. Brown admitted as much when we spoke earlier in the week. It’d had been tough for a while but they were coming right.

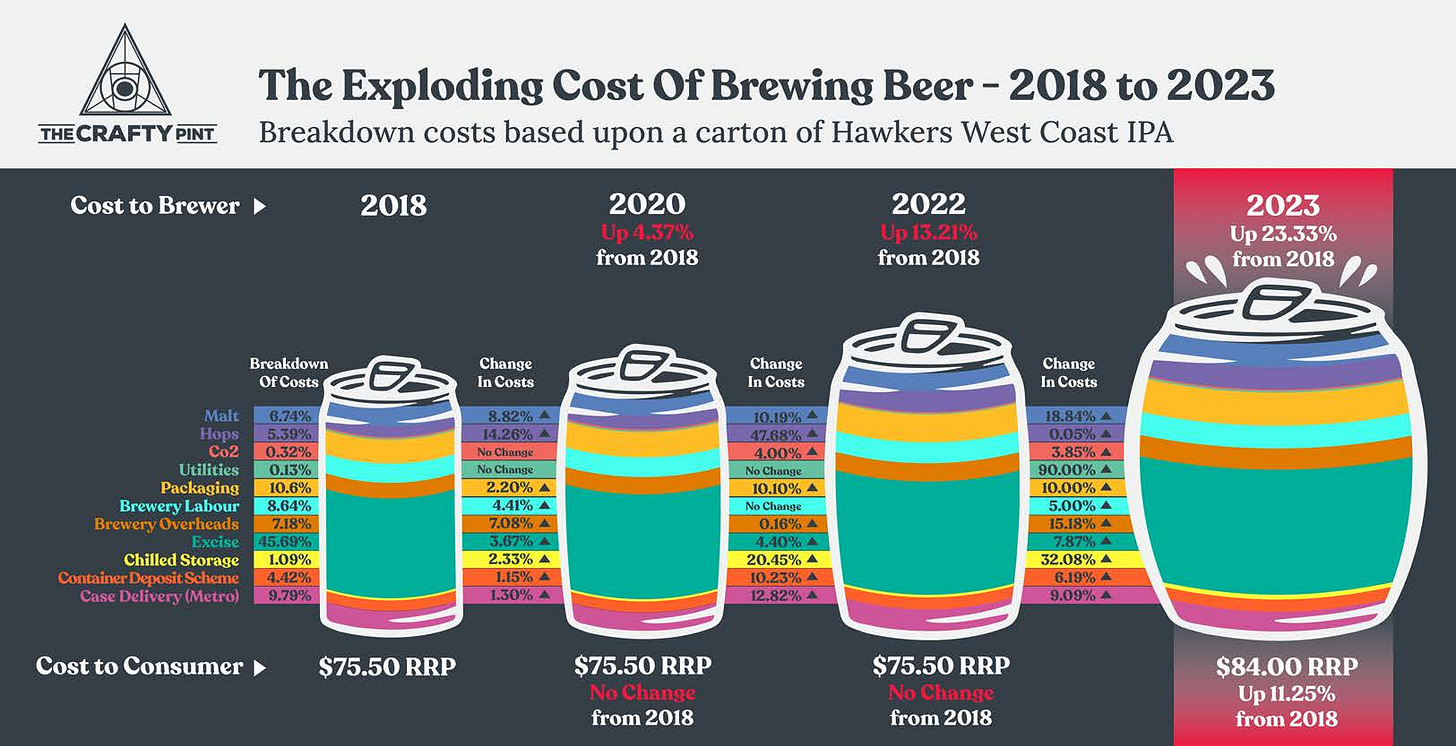

There’s no getting around the fact that the cost of everything has gone up but the price of craft beer has not moved all that much. It just so happens that at the time I was writing that above sentence, a great yarn landed from our friends at The Crafty Pint in Australia, about how breweries had absorbed most of the rising costs of the past three years. They represent it perfectly in this graph:

Same applies here: there’s less profit per can.

On top of that breweries are selling less beer because consumers are faced with stark choices about where to put their discretionary dollars, and according to another story I read this week, treats are out as more money goes on car loans and mortgages. (Might be paywalled). Or as global giant Heineken it put it this week: beer volume in the last quarter has declined due to “challenging economic conditions” in many markets and lower consumer demand after “inflation-led pricing”.

It’s hard to get finance when you’re in a hole. Food and beverage as a rule have been no-go areas for lenders in the past couple of years. The risk is too high. That’s why you’ve seen cafes, restaurants and pseudo-supermarkets go out of business. What hit Supie was a lack of investor confidence and they lost their venture capital backing. Deep Creek went looking for finance but couldn’t get any. Epic had an investor carrying them towards their destination but the load got, not heavy, just uncomfortable, so they ditched them. It turns out the same investor now half-owns the company. Also, once upon a time stainless steel kit would have been collateral against a loan, but the market for used breweries is not great right now.

Speaking of stainless steel, Deep Creek made a massive upgrade to their brewery in late-2021, investing $1 million on new kit that had capacity to produce 7 million litres. But at the time of liquidation, Deep Creek were still a “medium” brewery with a production of around 2.5 million litres per year. The quantum jumps that are often required to “grow” in beer are huge fiscal burdens — it’s hard to gradually increase production. Another irony. Deep Creek’s old brewery has just been upgrade and re-commissioned by Hop Federation and they are loving it.

What price did Deep Creek pay, in the long run, for selling off the Browns Bay bar where it all started? The Browns Bay Brewing Co, which now brews on that site, has been at pains this week to point out that they are going OK thanks, keep coming.

While having a hospo arm is not the answer to all problems, good brewpubs deliver decent cash-flow. The flip side is that you needed to have survived Covid. And, as we learned with Brothers Beer, it’s hard to run hospo and drive a a big production brewery.

A few other salient points out of this:

Deep Creek was split into two companies, the brewing operations and the IP. The IP side is not in liquidation. The brand can live on, possibly. Maybe the owners (the same owners as the brewing operation, Waiake Holdings Ltd) could keep producing Deep Creek beer under contract, at least for export.

It’s a big blow for the popular Isthmus Brewing. Isthmus is owned by Hamish Ward and his wife Caroline. Hamish was the head brewer at Deep Creek, where he also brewed Isthmus. He now has to find a new production facility for Isthmus. Let’s hope he can keep that going.

This is not the end of the world for beer in New Zealand. Yes, it’s incredibly tough and I do fear we will see more well-known brands falter. But for the three breweries that have hit financial strife in the past 3-4 months I can name many others that have started up in the past year — admittedly way smaller scale — the likes of Alchemy Street, Batsmen, Bean Bag Brewing, Thief, Gambit, Double Cone.

In all this it’s important to recognise what Deep Creek brought to the table: they were probably the best producers of fruited kettle sour beers in the country, with Aloha in particular winnings strings of medals. Dustry Gringo, a hoppy brown ale, is loved and adored by many (not the least me). Their beers will be missed.

People. Deep Creek — from the top down — was made up of a great people. I wish all of them the very best for the future.

Beer of the week No 1

Around 13 months ago I raved about this beer and I now credit myself with the foresight to have purchased a dozen of them. A year on, this is drinking superbly. The label may have a certain sad irony now that Deep Creek is no more, but this is a beer worthy of toasting a brewery that really did make a huge impact on the beer scene in New Zealand and will be sorely missed.

As I wrote last year: Making a 9 per cent Belgian Tripel takes some big assets (that’s my gender neutral term). And what’s more, it’s a spot-on example. I loved it. I reckon that in brewing this style it could be easy to tip over into harsh, astringent, boozy … so keeping the alcohol, spicy yeast character, phenols and bitterness all in check is so important. And Deep Creek achieved this. Plus it’s smooth as silk (even creamier a year on), with a soft mouthfeel and all the flavours huddled together in a tight team formation, and there’s a firm, spicy-bitter finish. Deep Creek were excellent producers of Belgian styles and this shows what we will miss.

Something about me …

I wasn’t going to share this, and haven’t listened yet, probably something to do with research that explains why we hate the sound of our own voices!

Anyway, I’m assured by a trusted friend that it’s a good listen, and it does talk about how I ended up here, from being a naive sports journalist at the Otago Daily Times to publishing Pursuit of Hoppiness and writing a beer missive on Substack:

What’s happening with Townshend

A few weeks ago it was announced that Townshend had stalled its equity raise on the platform Equitise.

Keep reading with a 7-day free trial

Subscribe to Friday Night Beers to keep reading this post and get 7 days of free access to the full post archives.